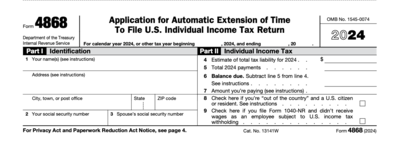

Citizens and Resident Aliens Abroad Who Expect To Qualify for Special Tax Treatment)Į an IRS authorized e-file website to extend the income tax due dates in simple steps and on the go. Individual Income Tax Returnįorm 2350 – Application for Extension of Time to File U.S. 100% safe.įorm 4868 – Application for Automatic Extension of Time To File U.S. You don’t have be a expert, applying for an extension is now made easy.

Either if you backup or trash your data, it should be made safe and secure as those papers contain information about your financial status.Get extra time to prepare and report your personal income taxes (Form 4868 and Form 2350) right, e-file your returns to the IRS securely in as few as 10 minutes. Once the papers are shredded throw away the in different trash cans which ensure safe disposal. When you want to trash your tax documents, shredding is advised.

All you need is strong security software in order to keep the hackers away from intruding your personal data. But in recent times with advanced technology, you are able to store all your data on your system conveniently. There are two sets of people who store all their papers safe for years, on another handsome dispose of all wastage on time. In the worst case, if you have missed or filed a fraudulent tax return then you must keep all your records forever. If more than 25% of the income is neglected from the tax return, IRS may impose an additional tax even after 6 years. Tax records that include dealing with a property like stocks or equipment must be kept until 3 years which runs out on the fiscal year and the tax is claimed. Unlike other cases, when dealing with retirement accounts you must keep the data for about seven years after which the funds have been withdrawn completely. For instance, if you have filed your personal tax return this year by April 18, 2017, for the tax year 2016 then you must keep the documents until April 15, 2020. According to the limitations outlined by IRS, you must keep your tax papers at least for 3 years from the date you filed your tax return. Tax documents such as the copy of filed tax return, W2, 1099, logs for mileage, receipts and other part works that support your tax return credits or deductions must be stored for a particular period. Keep the tax information, documentation, and copy of your tax return without fail. You must keep the documents safe for future reference if needed. It is not just filing your tax return and submitting before the due date. But before making your tax file papers flying in air note how long you need to keep those papers safe. Now it’s time to get some air, as the tax filing deadline has passed away.

0 kommentar(er)

0 kommentar(er)